How To Open A Roth Ira Vanguard

How to Open up a Roth IRA with Vanguard. Anyone with earned income can contribute to a Roth IRA.

Vanguard Roth Ira Account Opening Review Pt Money

Vanguard Roth Ira Account Opening Review Pt Money

Open a new account.

How to open a roth ira vanguard. Plus the spouse gets access to the same wide variety of investment choices ranging from mutual funds and exchange-traded funds ETFs to individual stocks and bonds. All investing is subject to risk including the possible loss of the money you invest. So if your child only makes 2000 in a year then they can only put 2000 into the Roth IRA.

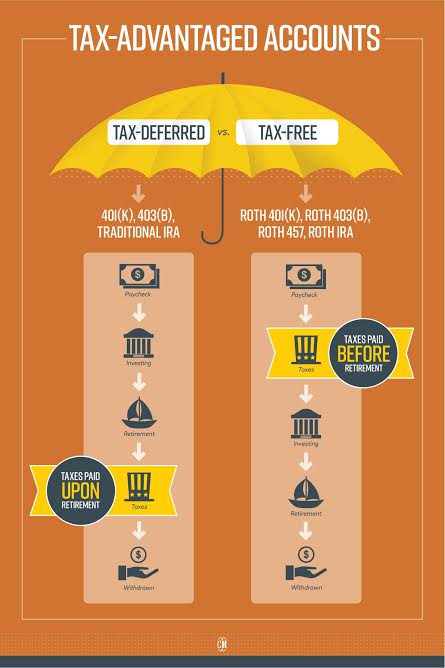

Move an account or assets to Vanguard. The process is very simple for setting up a Roth IRA with Vanguard for teens but it will require you calling the company to set it up and having a minimum 1000 to invest. Roth IRA rules dictate that as long as youve owned your account for 5 years and youre age 59½ or older you can withdraw your money when you want to and you wont owe any federal taxes.

Select Open a new account. Check the Roth IRA contribution limits. Name beneficiaries for your IRA.

The contribution limit is 6000 for 2020 or 100 of earned income whichever is less. Opening a Roth IRA can be as simple as visiting your banks website and filling out an online application. Brokerage Account Backdoor Roth Step 1.

When asked to select your funding method choose Exchange and then follow the remaining instructions. Youll be asked to provide some personal details including contact information and your Social Security number. A Roth IRA can set teenagers up for a comfortable financial future.

After completing your account profile youll be asked for bank account information so Vanguard can. Select an investment account type that works for your goals such as saving for retirement an IRA general investing or saving for education a 529 plan. Use this process to open a new Vanguard Brokerage Account for individuals or trusts.

Pick investments for your IRA. You will be confronted by a wizard which will ask you a number of questions. Move money directly from your bank to your new Vanguard IRA electronically.

Vanguard and Morningstar Inc as of December 31 2019. Opening a Roth IRA is simple. Make sure you qualify for a Roth IRA.

Advantages of a spousal IRA. Open a Vanguard Uniform Gifts or Transfers to Minors UGMAUTMA account. Begin the process to open an account online.

Heres how to set up a Roth IRA. I wrote about transferring a Roth IRA from another institution here. Transfer an account to Vanguard.

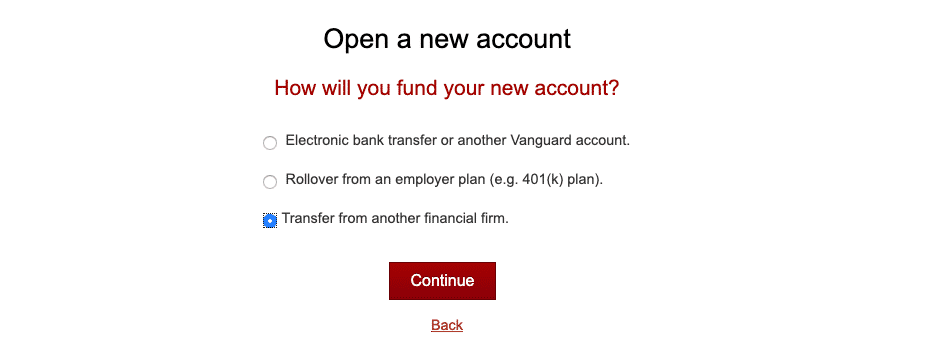

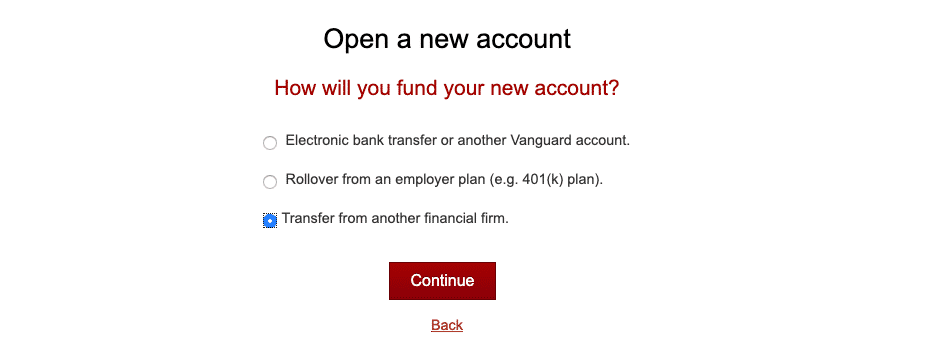

Move assets from an IRA at another financial institution to a new or existing Vanguard mutual fund IRA. But you dont have to handle the process on your own. Well send instructions once your IRA is open Avoid the 20 annual account service fee by registering your accounts online and signing up for e-delivery.

Uniform Gifts or Transfers to Minors Enrollment Kit. If your bank doesnt offer Roth IRA accounts you can open one with a brokerage firm. The first step in the process is choosing the specific account youre looking to open.

Most large firms also offer online access to start the account application. When taking withdrawals from an IRA before age 59½ you may have to pay ordinary income tax plus a 10 federal penalty tax. Children under the age of 18 need a custodial Roth IRA.

For more check out how to open a Roth IRA. Start your new account. Make a Non-Deductible IRA Contribution After logging in I point to My Accounts - Balance holdings Find your Traditional IRA brokerage account and click the arrow to the right of Buy and Sell and select Buy Vanguard funds Vanguard asks if its a rollover from another tax-deferred account.

A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. If you dont have 1000 or would prefer more features or a higher-end investors dashboard check out the other top five Roth IRA providers listed above every single one has no minimum and is comission free. A spousal IRA provides a way to boost your retirement savings as a couple.

If theres more than one Vanguard mutual fund in your traditional IRA you can only exchange one fund when you first open the Roth IRA. Youll just need your bank account and routing numbers found on your bank checks. Click Open an account in the top right of the page.

Meet the Roth IRA contribution deadline.

Vanguard Roth Ira Explained For Beginners Tax Free Millionaire Youtube

Vanguard Roth Ira Explained For Beginners Tax Free Millionaire Youtube

Vanguard 101 Automatic Investments Fly To Fi

Vanguard 101 Automatic Investments Fly To Fi

Vanguard Roth Ira For Teenagers In 2021 Teen Financial Freedom

Vanguard Roth Ira For Teenagers In 2021 Teen Financial Freedom

How To Set Up A Backdoor Roth Ira At Vanguard Youtube

How To Set Up A Backdoor Roth Ira At Vanguard Youtube

How To Roll Over Your Roth Ira From Betterment To Vanguard And Why I Did It Financial Panther

How To Roll Over Your Roth Ira From Betterment To Vanguard And Why I Did It Financial Panther

My Experience Opening Up A Vanguard Roth Ira Financial Product Reviews

How To Set Up A Roth Ira Through Vanguard Youtube

How To Set Up A Roth Ira Through Vanguard Youtube

Tutorial How Do I Convert A Traditional Ira To A Roth Ira Vanguard Support

Tutorial How Do I Convert A Traditional Ira To A Roth Ira Vanguard Support

Vanguard Roth Ira Guide Opening Account Buying Stock Automatic Investing Drip Youtube

Vanguard Roth Ira Guide Opening Account Buying Stock Automatic Investing Drip Youtube

How To Buy Vanguard Index Funds In 2021 Benzinga

How To Buy Vanguard Index Funds In 2021 Benzinga

Backdoor Roth Ira Pharmacist Money Blog

Backdoor Roth Ira Pharmacist Money Blog

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

How Do I Buy A Vanguard Mutual Fund Online Vanguard

How Do I Buy A Vanguard Mutual Fund Online Vanguard

How To Open Accounts With Vanguard Fidelity And Schwab Choosefi

How To Open Accounts With Vanguard Fidelity And Schwab Choosefi

How To Convert A Roth Ira At Vanguard An Illustrated Tutorial

How To Convert A Roth Ira At Vanguard An Illustrated Tutorial

Step By Step Guide To Opening A Vanguard Roth Ira Biglaw Investor

Step By Step Guide To Opening A Vanguard Roth Ira Biglaw Investor

Backdoor Roth Ira Ultimate Guide And Tutorial

Backdoor Roth Ira Ultimate Guide And Tutorial

How To Open A Roth Ira With Vanguard Easy Guide Retirement Planning Why Vanguard Youtube

How To Open A Roth Ira With Vanguard Easy Guide Retirement Planning Why Vanguard Youtube

Post a Comment for "How To Open A Roth Ira Vanguard"