How To Get Stimulus Check If Just Filed Taxes

An alarming 9 million Americans have yet to receive their 1200 coronavirus stimulus checks. Youll need to file the standard 1040 federal tax return form or the 1040-SR tax return for people 65 or older to get your missing stimulus money in the form of a tax credit that will either lower the amount of tax you owe or increase the size of your refund.

Whoops Tax Refund Irs Income Tax Return

Whoops Tax Refund Irs Income Tax Return

But what if you didnt.

How to get stimulus check if just filed taxes. While its possible that your stimulus check or even tax refund check could be delayed this year according to the IRS the additional programming and testing that resulted in the late Feb. The IRS is asking employers and others to help get the word out about these stimulus. If your bill is reduced to 0 the rest of the money will be.

Now that I have filed my 2019 tax return I now qualify for a stimulus check because my income was much lower than 2018. Nonfilers and stimulus checks. Your AGI can be found on line 8b of your 2019 Form 1040.

If you use our first stimulus check calculator or second payment calculator and find you may have qualified for a larger stimulus payment than you received use the IRS Get My Payment tool to see. When the first round of stimulus checks started I had not yet filed my 2019 taxes and I did not qualify for a stimulus check. If you do qualify for additional stimulus money you wont get it immediately.

What you need to know if you never file taxes. If youre over age 65 for example and receive Supplemental. If you think the IRS owes you stimulus money you can use a recovery rebate worksheet to calculate how much you should receive and claim that amount on Line 30 on your 2020 tax return.

This is partly due to many of them not filing tax returns. It will first be applied to your outstanding tax bill. Though taxes do play a role in determining stimulus check eligibility you dont need to have filed a tax return to qualify for a check.

If youre required to file a tax return the IRS will use information from your most recent filed tax return 2018 or 2019 to issue your stimulus payment. Taxpayers who earn income more than the IRS income thresholds for filing are required to file a tax return. Why you may be missing stimulus money.

Eligibility for stimulus payments is determined by the IRS based on your adjusted gross income AGI. Unless the IRS mailed your check right at the deadline or your payment is caught up in a direct deposit holdup with tax preparers youll need to claim money from the 600 stimulus check as a. If a program youre part of doesnt require you to file taxes you may be in the sticky situation of needing to file.

Americans who filed their taxes in 2018 or 2019 if they have already done so may use the IRS Get My Payment app launching in mid-April to check their payment status confirm their payment. In the last case you may get a stimulus check if you dont update the IRS but you will not get the extra 500 available per dependent unless you fill out the form to tell them. Instead go ahead and file your taxes and then the IRS will send you a stimulus check if you are eligible.

A big complaint about the CARES Act stimulus checks has been that eligibility was based on 2018 or 2019 income but you still might be able to access the benefit when you file your 2020 taxes next. Adjusted gross income AGI is your gross income like wages salaries or interest minus adjustments for eligible deductions like student loan interest or your IRA deduction. Some of the most common income thresholds for taxpayers under 65 in 2019 are.

In September the IRS sent out letters notifying them that they may be entitled to a stimulus payment also known as an Economic Impact Payment. How to Get a Stimulus Check if You Dont File a Tax Return Economic stimulus payments are generally based on information from 2018 or 2019 tax returns but non-filers can still get a check. If youre eligible for a stimulus check not everyone will get one the IRS will grab the information it needs to process your payment from your 2018 or 2019 tax return.

This Is How To Calculate You 1 400 Stimulus Check Total If The Latest Proposal Holds Payroll Taxes Filing Taxes Two By Two

This Is How To Calculate You 1 400 Stimulus Check Total If The Latest Proposal Holds Payroll Taxes Filing Taxes Two By Two

Pin On Debt Free Community Group Board

Pin On Debt Free Community Group Board

What Do I Do If I Didn T Get My First Or Second Stimulus Checks Get It Back Tax Credits For People Who Work

What Do I Do If I Didn T Get My First Or Second Stimulus Checks Get It Back Tax Credits For People Who Work

It S Finally Time To Claim Missing Stimulus Money On Your 2020 Refund Here S How Cnet

It S Finally Time To Claim Missing Stimulus Money On Your 2020 Refund Here S How Cnet

Biden S Third Stimulus Check Would Have A 1 400 Cap Here S The Total Payment Size You Could Get Adopting A Child Filing Taxes Paying Taxes

Biden S Third Stimulus Check Would Have A 1 400 Cap Here S The Total Payment Size You Could Get Adopting A Child Filing Taxes Paying Taxes

Pin On Covid 19 Freebies Resources

Pin On Covid 19 Freebies Resources

Filing Taxes To Claim Stimulus Money You Need Your Agi Here S What It Is And How To Find It Cnet

Filing Taxes To Claim Stimulus Money You Need Your Agi Here S What It Is And How To Find It Cnet

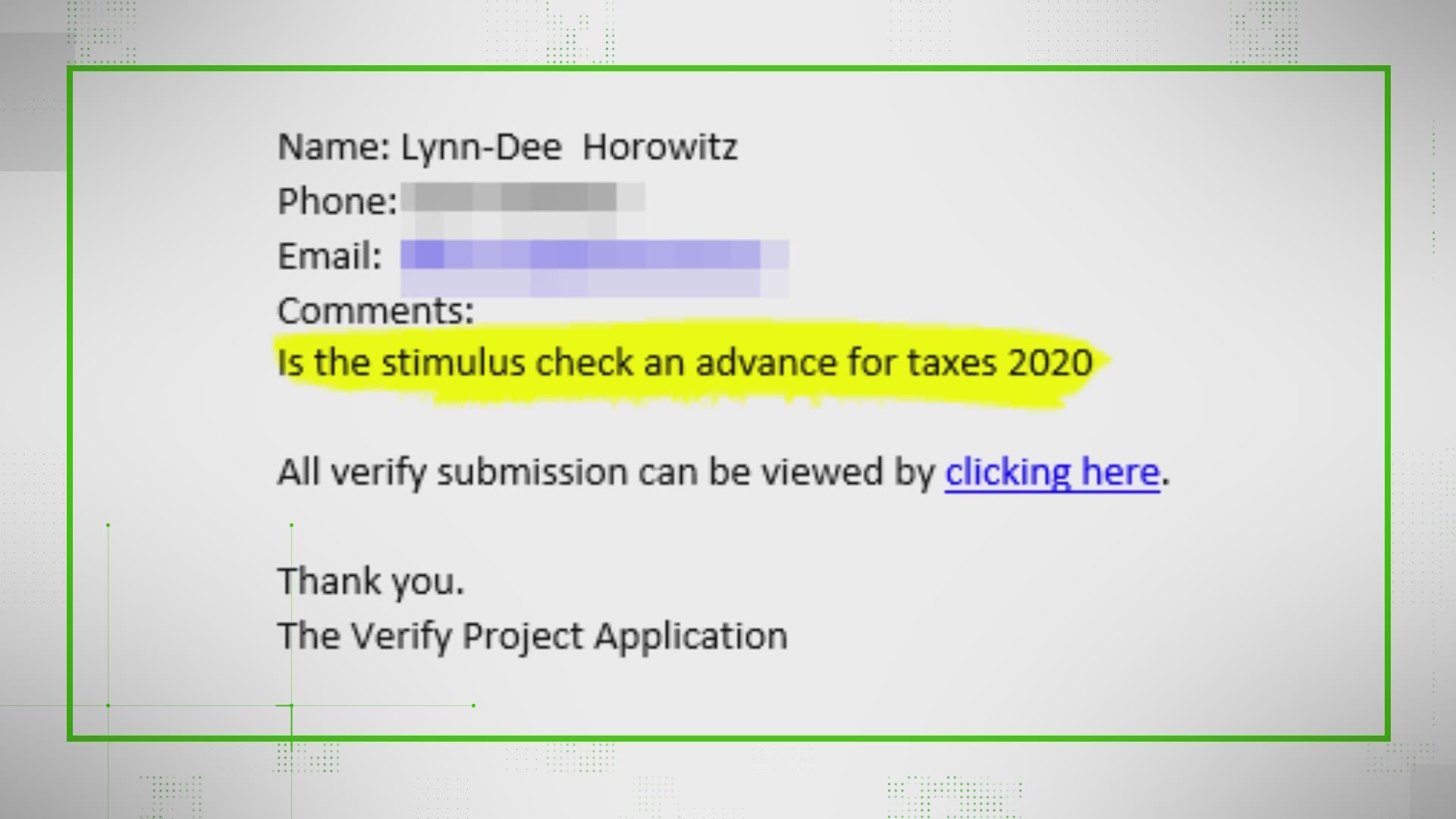

Stimulus Checks And Your Taxes What You Need To Know When You File Your 2020 Tax Return Cnet

Stimulus Checks And Your Taxes What You Need To Know When You File Your 2020 Tax Return Cnet

Missing Stimulus Payment But Aren T Required To File Taxes Irs Says You Ll Have To File This Year To Get That Money Abc7 Chicago

Missing Stimulus Payment But Aren T Required To File Taxes Irs Says You Ll Have To File This Year To Get That Money Abc7 Chicago

Stimulus Checks And Your Taxes What You Need To Know When You File Your 2020 Tax Return Cnet

Stimulus Checks And Your Taxes What You Need To Know When You File Your 2020 Tax Return Cnet

600 Stimulus Check Didn T Get A Payment Or The Full Amount Khou Com

600 Stimulus Check Didn T Get A Payment Or The Full Amount Khou Com

Stimulus Check Delivery During Tax Season Answers To What You Re Asking Or Should Be Cnet

Stimulus Check Delivery During Tax Season Answers To What You Re Asking Or Should Be Cnet

Didn T Get A 2nd Stimulus Check Here S How To Free File With The Irs In 2021 Tax Refund Irs Taxes Irs

Didn T Get A 2nd Stimulus Check Here S How To Free File With The Irs In 2021 Tax Refund Irs Taxes Irs

What S My Stimulus Check Status How To Make Sure You Get Your Check Personal Finance Blogs Filing Taxes Finance Blog

What S My Stimulus Check Status How To Make Sure You Get Your Check Personal Finance Blogs Filing Taxes Finance Blog

Stimulus Check Qualifications Fine Print Income Limit How The First Payment May Impact The Next Relief Package In 2020 Tax Deadline Prepaid Debit Cards Supplemental Security Income

Stimulus Check Qualifications Fine Print Income Limit How The First Payment May Impact The Next Relief Package In 2020 Tax Deadline Prepaid Debit Cards Supplemental Security Income

Need To Know How Those Who Didn T File Taxes Can Get A Stimulus Check Cbs19 Tv

Need To Know How Those Who Didn T File Taxes Can Get A Stimulus Check Cbs19 Tv

Nonfilers And Stimulus Checks What You Need To Know If You Never File Taxes Cnet

Nonfilers And Stimulus Checks What You Need To Know If You Never File Taxes Cnet

Post a Comment for "How To Get Stimulus Check If Just Filed Taxes"